Year: 2017

Five Key Trends in Benefits Impacting Business Success

ANSAS CITY, Mo., July 5, 2017 /PRNewswire/ — For employers, benefit offerings have a significant impact on the cost of doing business. Relying on traditional approaches to managing medical costs and measuring benefits is no longer enough. Lockton, the world’s largest privately held insurance broker, knows employers need to evaluate factors, including costs, health risks, business value, and the healthcare delivery and payment infrastructure to determine the best options for their business.

In a new white paper, Five Trends Changing the Way We Think About Medical Costs and Benefits Value, Lockton Benefit Group’s Chief Medical Officer Ron Leopold, shares five keys to impacting business success through employee health, engagement, productivity and culture:

- Analytics Focus on True Medical Cost Drivers

- Healthcare Delivery Is Transforming

- Well-Being Improves Engagement and Work Performance

- Health and Productivity Are Hard Coded Together

- The Cost of Our Health Is in Our Own Hands

Learn more about each of these trends and practical considerations for employers in the full white paper.

Lockton Benefit Group’s Health Risk Solutions Practice is led by Chief Medical Officer Ron Leopold, MD, and National Program Manager Heidi Guetzkow. Joined by Health Risk Solutions Consultants in Lockton offices nationwide, their mission is to assist clients in understanding their businesses and reviewing data to determine the right goals and strategies to deploy for a healthier and less costly workforce.

About Lockton

Lockton is a global professional services firm with 6,500 Associates who advise clients on protecting their people, property and reputations. Lockton has grown to become the world’s largest privately held, independent insurance broker by helping clients achieve their business objectives. For eight consecutive years, Business Insurance magazine has recognized Lockton as a “Best Place to Work in Insurance.” For more information, visit www.lockton.com.

SOURCE

Lockton

PR Newswire

Related Links

Bankrate to Be Acquired by Red Ventures for $14.00 per Share

NEW YORK and CHARLOTTE, N.C., July 3, 2017 /PRNewswire/ — Bankrate (NYSE: RATE), a leading online publisher, aggregator, and distributor of personal finance content, today announced that it has entered into a definitive agreement to be acquired by Red Ventures, a leading digital consumer choice platform, in an all-cash transaction that values Bankrate at an enterprise value of approximately $1.4 billion. Under the terms of the merger agreement, Bankrate shareholders will receive $14.00 per share in cash, which represents a premium of approximately 31 percent over Bankrate’s three-month average closing share price. The merger agreement has been unanimously approved by Bankrate’s Board of Directors.

The combination will create a scaled and diversified digital platform of consumer marketplaces. Bankrate is a leading consumer financial services company with online brands across personal finance categories, including credit cards, banking and senior care. Red Ventures uses advanced analytics, data science and integrated technology to cultivate digital connections between brands and consumers across the financial services, home services and healthcare industries. Bankrate’s comprehensive platform and millions of users across multiple brands will deepen Red Ventures’ footprint in the financial services industry and enhance relationships between financial services providers and consumers looking for trusted, authoritative information when making decisions about their personal finances and senior care.

“We’re excited to join forces with the Bankrate team, which has built an impressive and powerful platform of consumer-facing financial services content and brands,” said Ric Elias, CEO of Red Ventures. “Our capabilities are highly complementary. We see significant potential to leverage our technology, strategic partnerships and digital expertise and build on Bankrate’s leading platforms to help more consumers find the financial services and products that meet their needs.”

“We are thrilled to have reached an agreement that delivers immediate and significant value to our shareholders while joining with Red Ventures, a world-class organization that will take the Bankrate businesses to the next level of success,” said Kenneth S. Esterow, President and CEO of Bankrate. “As a part of Red Ventures, Bankrate will be better positioned than ever to be the partner of choice for providers to acquire customers.”

The transaction, which is expected to close in 2017, is subject to approval by Bankrate shareholders, regulatory approval and other customary closing conditions.

J.P. Morgan Securities LLC is acting as exclusive financial advisor and Wachtell, Lipton, Rosen & Katz is acting as legal advisor to Bankrate. Bank of America, Barclays, Citi, Credit Suisse, Fifth Third, MUFG and PNC are acting as financial advisors and are providing debt financing to Red Ventures. Simpson Thacher & Bartlett LLP is acting as legal advisor to Red Ventures.

About Bankrate Bankrate (NYSE: RATE) is a leading online publisher, aggregator, and distributor of personal finance content. The Company’s vision is to help consumers Maximize Your Money™ when they borrow, save or invest. With this in mind, RATE aggregates large scale audiences of in-market consumers by providing them with proprietary, fully researched, comprehensive, independent and objective personal finance and related editorial content across multiple vertical categories including credit cards, mortgages, deposits, senior care and other categories, such as personal and auto loans retirement, and taxes. RATE’s flagship sites CreditCards.com, Bankrate.com, and Caring.com are leading destinations in each of their respective verticals and connect their vast audiences with financial service and senior care providers and other contextually relevant advertisers. RATE also owns and operates a number of specialist sites, apps and social platforms, including NextAdvisor.com, The Points Guy, Interest.com, Quizzle.com and Walla.by. Bankrate also develops and provides content, tools, web services and co-branded websites to over 100 online partners, including Yahoo!, CNBC and MarketWatch. In addition, Bankrate licenses editorial content to leading news organizations such as The Wall Street Journal and The New York Times.

About Red Ventures Red Ventures is a leading digital consumer choice platform based in Charlotte, North Carolina. Through deeply integrated brand partnerships and consumer-facing assets, Red Ventures connects online customers with products and services across high-growth industries including home services, financial services, and healthcare. Founded in 2000, Red Ventures has more than 2,700 employees in offices across the Carolinas, Seattle, Washington, and Sao Paulo, Brazil. For more information, visit www.redventures.com.

Media Contacts

Bankrate Ken Stelzer ken.stelzer@bankrate.com 917.438.9544

Red Ventures Patricia Graue redventures@brunswickgroup.com 212.333.3810

Additional Information and Where to Find It

This communication relates to the proposed merger transaction involving Bankrate, Inc. (“Bankrate”). In connection with the proposed merger, Bankrate will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Bankrate’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Bankrate may file with the SEC or send to its stockholders in connection with the proposed merger. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF BANKRATE ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, http://www.sec.gov, and Bankrate’s website, www.bankrate.com. In addition, the documents (when available) may be obtained free of charge by directing a request to Ken Stelzer by email at Ken.Stelzer@Bankrate.com or by calling 917-438-9544.

Participants in Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Bankrate common stock in respect of the proposed transaction. Information about the directors and executive officers of Bankrate is set forth in the proxy statement for Bankrate’s 2017 annual meeting of stockholders, which was filed with the SEC on April 28, 2017, and in other documents filed by Bankrate with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Cautionary Statements Regarding Forward-Looking Information

Certain statements contained in this communication may constitute “forward-looking statements.” Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the failure to obtain Bankrate stockholder approval of the transaction or the failure to satisfy any of the other conditions to the completion of the transaction; the effect of the announcement of the transaction on the ability of Bankrate to retain and hire key personnel and maintain relationships with its customers, providers, advertisers, partners and others with whom it does business, or on its operating results and businesses generally; risks associated with the disruption of management’s attention from ongoing business operations due to the transaction; the ability to meet expectations regarding the timing and completion of the merger; and other factors detailed in Bankrate’s Annual Report on Form 10-K filed with the SEC for the fiscal year ended December 31, 2016 and Bankrate’s other filings with the SEC, which are available at http://www.sec.gov and on Bankrate’s website at www.bankrate.com. Bankrate assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

SOURCE

Bankrate

prnewswire.com

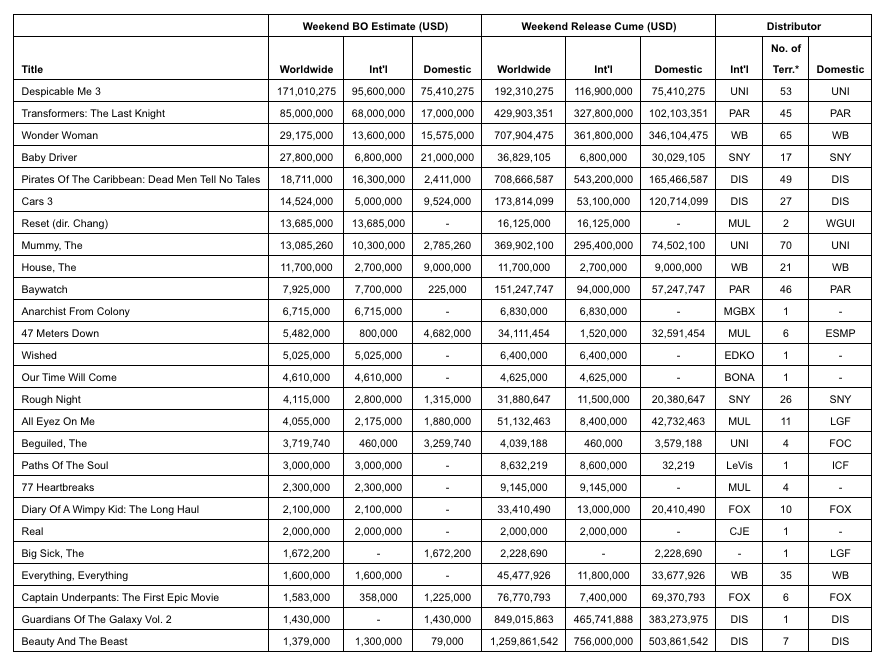

comScore Announces Official Worldwide Box Office Results for Weekend of July 2, 2017

NEWS PROVIDED BY

comScore & PR Newswire

LOS ANGELES, July 2, 2017 /PRNewswire/ — comScore today announced the official worldwide weekend box office estimates for the weekend of July 2, 2017, as compiled by the company’s theatrical measurement services.

As the trusted official standard for real-time worldwide box office reporting, comScore provides the only theater-level reporting in the world. Customers are able to analyze admissions and gross results around the world using comScore’s suite of products.

comScore’s Senior Media Analyst Paul Dergarabedian commented, “Universal’s animated ‘Despicable Me 3’ from Illumination Entertainment tops the global box office chart taking in $171 million this weekend while enjoying it’s North American debut and a total to date of $192.3 million. Notably, Paramount’s ‘Transformers: The Last Knight’ crosses the $400 million mark while Warner Bros.’ ‘Wonder Woman’ has now crossed the $700 million mark worldwide.”

The top 12 worldwide weekend box office estimates, listed in descending order, per data collected as of Sunday, July 2, are below.

- Despicable Me 3 – Universal – $171.0M

- Transformers: The Last Knight – Paramount Pictures – $85.0M

- Wonder Woman – Warner Bros. – $29.2M

- Baby Driver – Sony – $27.8M

- Pirates Of The Caribbean: Dead Men Tell No Tales – Disney – $18.7M

- Cars 3 – Disney – $14.5M

- Reset (dir. Chang) – Multiple – $13.7M

- Mummy, The – Universal – $13.1M

- House, The – Warner Bros. – $11.7M

- Baywatch – Paramount Pictures – $7.9M

- Anarchist From Colony – Megabox – $6.7M

- 47 Meters Down – Multiple – $5.5M

The top 12 domestic weekend box office estimates, listed in descending order, per data collected as of Sunday, July 2, are below.

- Despicable Me 3 – Universal – $75.4M

- Baby Driver – Sony – $21.0M

- Transformers: The Last Knight – Paramount – $17.0M

- Wonder Woman – Warner Bros. – $15.6M

- Cars 3 – Disney – $9.5M

- House, The – Warner Bros. – $9.0M

- 47 Meters Down – Entertainment Studios Motion Pictures – $4.7M

- Beguiled, The – Focus Features – $3.3M

- Mummy, The – Universal – $2.8M

- Pirates Caribbean: Dead Men Tell No Tales – Disney – $2.4M

- All Eyez On Me – Lionsgate – $1.9M

- Big Sick, The – Lionsgate – $1.7M

Full details regarding the global domestic and international box office results are listed in the table below.

*Territory is a movie studio term for regions of the world consisting of various countries.

© 2017 comScore – Content in this chart is produced and/or compiled by comScore and its Box Office Essentials and International Box Office Essentials data collection and analytical services, and is covered by provisions of the Copyright Act. The material presented herein is intended to be available for public use. You may reproduce the content of the chart in any format or medium without first obtaining permission, subject to the following requirements: (1) the material must be reproduced accurately and not in a misleading manner; (2) any publication or issuance of any part of the material to others must acknowledge comScore as the source of the material; and (3) you may not receive any monetary consideration for reproducing, displaying, disclosing or otherwise using any part of the material.

About comScore

comScore is a leading cross-platform measurement company that measures audiences, brands and consumer behavior everywhere. comScore completed its merger with Rentrak Corporation in January 2016, to create the new model for a dynamic, cross-platform world. Built on precision and innovation, our data footprint combines proprietary digital, TV and movie intelligence with vast demographic details to quantify consumers’ multiscreen behavior at massive scale. This approach helps media companies monetize their complete audiences and allows marketers to reach these audiences more effectively. With more than 3,200 clients and global footprint in more than 75 countries, comScore is delivering the future of measurement. Shares of comScore stock are currently traded on the OTC Market (OTC:SCOR). For more information on comScore, please visit comscore.com.

SOURCE

comScore

PR Newswire

Related Links

EOS Token Distribution Generates Over US$185 Million in First Five Days

NEWS PROVIDED BY

block.one & PR Newswire

GEORGE TOWN, Cayman Islands, July 1, 2017 /PRNewswire/ — block.one, the developer of EOS.IO software, a new blockchain operating system designed to support commercial-scale decentralized applications, today has successfully received 651,902 ether (“ETH”), which is approximately US$185 million, in the first five days of its 341-day long token distribution. In exchange, 200 million EOS ERC-20 compatible tokens (“EOS Tokens”) were distributed to purchasers (representing 20 percent of the total one billion EOS Tokens being distributed).

The distribution of EOS Tokens began on June 26, 2017. The distribution uses a ground-breaking token participation model by creating what is intended to be the fairest token distribution project launched on Ethereum to date. This elongated timeframe eliminates the quick frenzy usually surrounding short token sales, and allows the community ample time to learn about the EOS.IO software being developed by block.one and participate in the token distribution if they wish.

The EOS Token distribution also approximates an auction where for every period, everyone gets the same price. At the end of a period, the respective set number of EOS Tokens for that period will be distributed pro rata amongst all authorized purchasers, based on the total ETH contributed during that period.

“We felt an approximately year-long token distribution was the best method to ensure people receive fair market value for EOS Tokens,” said Brendan Blumer, CEO of block.one. “We anticipate that strong interest will continue throughout the year as the community continues to learn about the EOS.IO software and the benefits it can bring to their business.”

Seven hundred million additional EOS Tokens (representing 70 percent of the total EOS Tokens being distributed) have been split evenly into 350 consecutive 23-hour periods of 2 million tokens each, and will be distributed at the close of each period. The remaining 100 million EOS Tokens (representing 10 percent of the total EOS Tokens being distributed) have been reserved for block.one as founder’s tokens pursuant to the feedback received from the community to ensure that block.one has aligned interests with those participating in the EOS Token distribution. If a blockchain adopting the EOS.IO software is launched, these founder’s tokens will be locked and released over a period of 10 years.

Many corporations are looking for a blockchain that provides the speed and performance required in order to run commercial-grade businesses.The EOS.IO software introduces asynchronous communication and parallel processing to support hundreds of thousands of transactions per second. The software on which EOS’s architecture is based establishes an operating system-like construct upon which applications can be built and eliminates the requirement for users to pay for every transaction. The software is intended to allow developers to build their own high performance applications on the blockchain and deploy their own monetization strategies without requiring users to necessarily pay to use those applications.

block.one intends for the EOS.IO software to support distributed applications that have the same look and feel as existing web-based applications, but with all of the benefits of the blockchain – namely transparency, security, process integrity, speed and lower transaction costs.

Full details about the EOS Token distribution including all terms and conditions can be found at eos.io and more information about the EOS.IO software can be found at https://github.com/EOSIO/Documentation/blob/master/TechnicalWhitePaper.md.

About block.one

block.one is a developer of technology solutions including blockchain software development. With employees and advisors based around the world, the company focuses on business-grade technology solutions, including the development of the EOS.IO software. For more information visit block.one.

Disclaimer

All statements in this press release, other than statements of historical facts, including any statements regarding block.one’s business strategy, plans, prospects, developments and objectives are forward looking statements. These statements are only predictions and reflect block.one’s current beliefs and expectations with respect to future events and are based on assumptions and are subject to risk, uncertainties and change at any time. We operate in a rapidly changing environment. New risks emerge from time to time. Given these risks and uncertainties, you are cautioned not to rely on these forward-looking statements. Actual results, performance or events may differ materially from those contained in the forward-looking statements. Some of the factors that could cause actual results, performance or events to differ materially from the forward-looking statements contained herein include, without limitation: market volatility; continued availability of capital, financing and personnel; product acceptance; the commercial success of any new products or technologies; competition; government regulation and laws; and general economic, market or business conditions. Any forward-looking statement made by block.one speaks only as of the date on which it is made and block.one is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

SOURCE

prnewswire.com

block.one

Related Links

Cerberus Capital Management Announces Sale of YP Holdings to Dex Media

NEWS PROVIDED BY

Cerberus Capital Management, L.P. & PR Newswire

NEW YORK, June 30, 2017 /PRNewswire/ — Cerberus Capital Management, L.P. (“Cerberus”) today announced that YP Holdings (“YP”), a leading local marketing solutions provider in the U.S., has been acquired by Dex Media. YP’s flagship consumer brands include YPSM app, yellowpages.com and The Real Yellow Pages® Directory, which will now be part of the combined company, to be named DexYP™. Financial terms of the transaction were not disclosed.

Added Michael F. Sanford, Co-Head of North American Private Equity and Managing Director of Cerberus, “This successful exit, together with two recapitalizations, generated very strong returns for our investors. I would like personally to thank all those at YP who worked so hard to guide the company through this evolution, and would particularly like to express our gratitude to our partners at AT&T who have supported us throughout this process.”

This transaction combines two iconic companies to create the largest national provider of local marketing solutions. This will result in industry benefits including product innovation and a nationwide platform to allow small businesses to compete and connect with ready-to-buy consumers.

“Combining YP and Dex is a natural evolution of our business. DexYP™ will leverage the power of both of our brands, our presence, and our people to make a bigger, better entity,” said Jared Rowe, CEO of YP. “Working to help local businesses succeed has always been our mission and this combination will ensure we will continue to carry out that mission. This transaction also builds upon all the great work YP has collectively done over the last five years. On behalf of the entire management team, I want to thank Cerberus and AT&T for their partnership over the years and, most importantly, thanks to all of our YP employees for their tireless efforts to make our company better every day.”

Cerberus’ investment in YP began in 2012 when it acquired a majority stake in the original Yellow Pages print and digital business from AT&T, which retained a minority equity interest. Since then the business has rebranded to YP and evolved into one of the leading digital local marketing platforms in the U.S., with a massive audience of more than 60 million monthly unique visitors across its properties, while still printing over 1,000 traditional directories in 21 states. YP’s revenues in 2016 were approximately $1.6 billion.

Goldman Sachs served as financial advisor to YP, while Schulte Roth & Zabel LLP acted as legal counsel to YP. Moelis & Company served as financial advisor to Dex Media, while Weil, Gotshal & Manges LLP acted as lead legal counsel to Dex Media.

About Cerberus Capital Management, L.P.

Established in 1992, Cerberus Capital Management, L.P. is one of the world’s leading private investment firms. Cerberus has more than US $30 billion under management invested in three complementary strategies: private equity; global credit opportunities (which includes non-performing loans, corporate credit and distressed debt, mortgage securities and assets, and direct lending); and real estate. From its headquarters in New York City and network of affiliate and advisory offices in the U.S., Europe and Asia, Cerberus has the on-the-ground presence to invest in multiple asset classes globally.

Contact

Andrew Johnson

646-495-2700

ajohnson@gpg.com

SOURCE

Cerberus Capital Management, L.P.

prnewswire.com

Shell Energy North America Signs Purchase Agreement To Acquire MP2 Energy LLC

NEWS PROVIDED BY

Shell Energy North America & PR Newswire

HOUSTON, June 29, 2017 /PRNewswire/ — Shell Energy North America (“SENA”) announced today that it has signed a purchase agreement for the acquisition of MP2 Energy LLC (MP2). Subject to regulatory approvals, the transaction is expected to be closed in the 3rd quarter of 2017.

Through self-developed proprietary systems and technology, MP2 provides market based solutions to commercial and industrial customers for managing energy supply, load, and generation. MP2 is unique in its skill set and at the front of the curve when it comes to developing fit for purpose solutions to its customers, which face ever more complicated energy choices.

“We are proud to bring MP2 into the Shell Energy North America family,” said Glenn Wright, VP, SENA. “MP2 has established itself as a significant player in the large end-user electricity market, and achieved its position by combining optimally designed energy solutions and exceptional customer service.”

SENA manages a successful retail energy business targeting large commercial and industrial customers on the west coast of the U.S. With the acquisition of MP2, SENA expands those capabilities and gains capabilities in Texas and throughout the eastern U.S., as well as access to MP2’s top tier network of aggregators, brokers, and consultants. “As Shell continues to expand its energy focus, we will strive to bring customers ever more innovative commodity solutions, including the deployment of new energy management tools,” said Wright.

When this acquisition closes, MP2 will continue to be managed by the existing MP2 management team as a wholly-owned subsidiary of Shell Energy North America. From its offices in The Woodlands, Texas, MP2 will utilize the additional resources that Shell provides to further develop and enhance the leading-edge services and products MP2 is built upon.

Note to editors

SENA and its subsidiaries operate as an integral part of the global Shell Trading network. The company and its subsidiaries trade and market natural gas, wholesale power, environmental and risk management products with counterparties and customers throughout the region. Its customers include large commercial and industrial users, retail energy companies, local gas distribution companies, electric utilities, independent power producers, oil and gas producers, municipalities, and rural electric cooperatives. SENA consistently ranks within the top three gas and power marketers in North America according to Platts. Capabilities include marketing natural gas within the U.S. and Canada, with a sales volume of 10 billion cubic feet per day; marketing wholesale and retail power, with sales topping 270 million megawatt hours annually; and participating in nearly all organized power markets, with access to over 9,500 megawatts of generating capacity across North America.

MP2 Energy is a top-tier power company that manages power plants, delivers retail power to end-use customers, and masters all other aspects of the power markets like asset management, commodity hedging, solar installation and offtake, wind and distributed generation.

Cautionary note

The companies in which Royal Dutch Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell group” and “Royal Dutch Shell” are sometimes used for convenience where references are made to Royal Dutch Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies. ”Subsidiaries”, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to companies over which Royal Dutch Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations” respectively. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in a venture, partnership or company, after exclusion of all third-party interest.

This announcement contains forward-looking statements concerning the financial condition, results of operations and businesses of Royal Dutch Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Royal Dutch Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as ”anticipate”, ”believe”, ”could”, ”estimate”, ”expect”, ”goals”, ”intend”, ”may”, ”objectives”, ”outlook”, ”plan”, ”probably”, ”project”, ”risks”, “schedule”, ”seek”, ”should”, ”target”, ”will” and similar terms and phrases. There are a number of factors that could affect the future operations of Royal Dutch Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; and (m) changes in trading conditions. There can be no assurance that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this announcement. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Royal Dutch Shell’s 20-F for the year ended December 31, 2016 (available at www.shell.com/investor and www.sec.gov). These risk factors also expressly qualify all forward looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, JUN 29, 2017. Neither Royal Dutch Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

We may have used certain terms, such as resources, in this announcement that United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov

SOURCE

Shell Energy North America

prnewswire.com

Recent Comments